Eligible Applicants

Eligible applicants for the SBA 504 program include for-profit small businesses with a net worth of less than $20 million and $6.5 million in profit after taxes.

Eligible Use

Acquisition of owner-occupied real estate (must occupy 51% of the building), new construction (must initially occupy 60% of the building), site improvements, building renovations, and machinery & equipment with a useful life of at least 10 years. Refinancing of existing commercial real estate and/or equipment debt may be eligible. Loans may not be used for working capital, venture capital, or investment purposes.

Loan Amount

The gross amount of the loan can be up to $5 million for regular loans and $5.5 million for Public Policy Goal loans as well as small manufacturers or 40% of the total eligible project costs (whichever is less). Additional equity requirements will reduce the SBA participation amount. The minimum loan size is $50,000.

Interest Rate

Interest rates are based on the sale of U.S. Treasury Bonds. Check here for the latest rates. The rate for a particular loan is not set until the project as defined is complete and the SBA 504 loan closes and funds. Once the rate is set it is fixed for the life of the loan.

Term

10 years for machinery and equipment; 20 or 25 years for real estate.

Equity Requirement

Existing businesses (must be in operation for at least years) must provide a minimum of 10% of the total project cost. New businesses or new ownership of businesses must provide a minimum of 15% of the total project cost. If the project involves a special-use property, an additional 5% will be required. Equity in project real estate may, in some cases, be used.

JOB REQUIREMENT

A project must create or retain one Job Opportunity per $95,000 of SBA 504 financing. For projects that meet a Public Policy Goal (Green Energy, Minority-Owned Business, Woman-Owned Business, Veteran-Owned Business, Rural Development), as long as SEDA-COG’s SBA 504 portfolio averages $150,000/job created or retained, the project would meet the job requirement of the SBA.

PREPAYMENT PENALTY

The SBA 504 loan has a prepayment penalty for the first 10 years (5 years for a 10-year 504 loan) on a declining scale based on the underlying note rate of the loan. The penalty goes down 10% every year (20% for a 10-year 504 loan) until the end of the prepayment penalty period. The prepayment penalty amount is based on the current outstanding balance of the loan at the time of early payoff.

SBA 504 vs Conventional Financing

Here’s how the financing would look for the purchase of a $1,000,000 commercial building assuming an existing small business (in operation for at least 2 years) and non-special use property. Use our SBA 504 Loan Calculator to estimate the monthly financing cost for your project.

Conventional Financing

- The lender provides 80% of the financing. In this example, $800,000.

- The amount of down payment required would be 20%. In this example, $200,000.

SBA 504

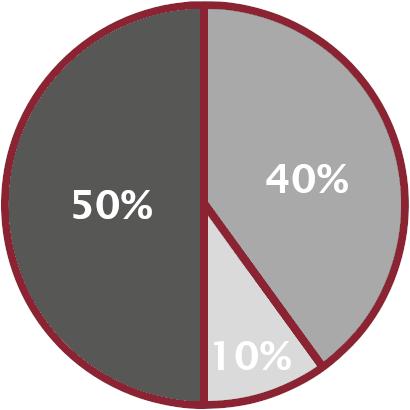

- The lender provides 50% of the financing. In this example, $500,000.

- The SBA 504 provides 40% of the financing as a separate loan. In this example, $400,000.

- The amount of down payment required would be 10%. In this example, $100,000.