SBA 504 loans are financed through the sale of public bonds, called debentures, that are backed by the U.S. Small Business Administration. The backing makes it possible to get very competitive fixed-interest rates over the life of the loan, whether it be 10, 20, or 25 years.

SBA 504 Effective Rate

The effective rate for an SBA 504 takes into account the interest and loan fees and monthly servicing fees that are repaid over the life of the loan. Therefore, the monthly payment includes the principal and interest plus a fraction of the fees built into the loan. There are no “hidden” fees from the interest rate that is quoted for the loan.

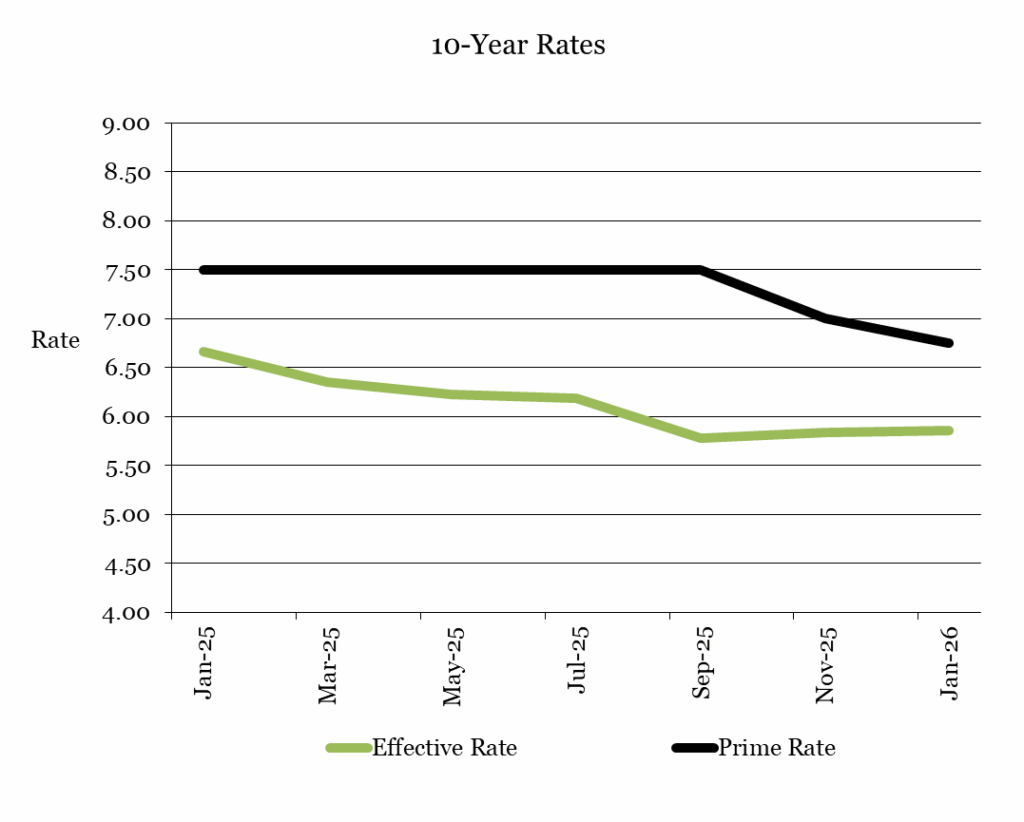

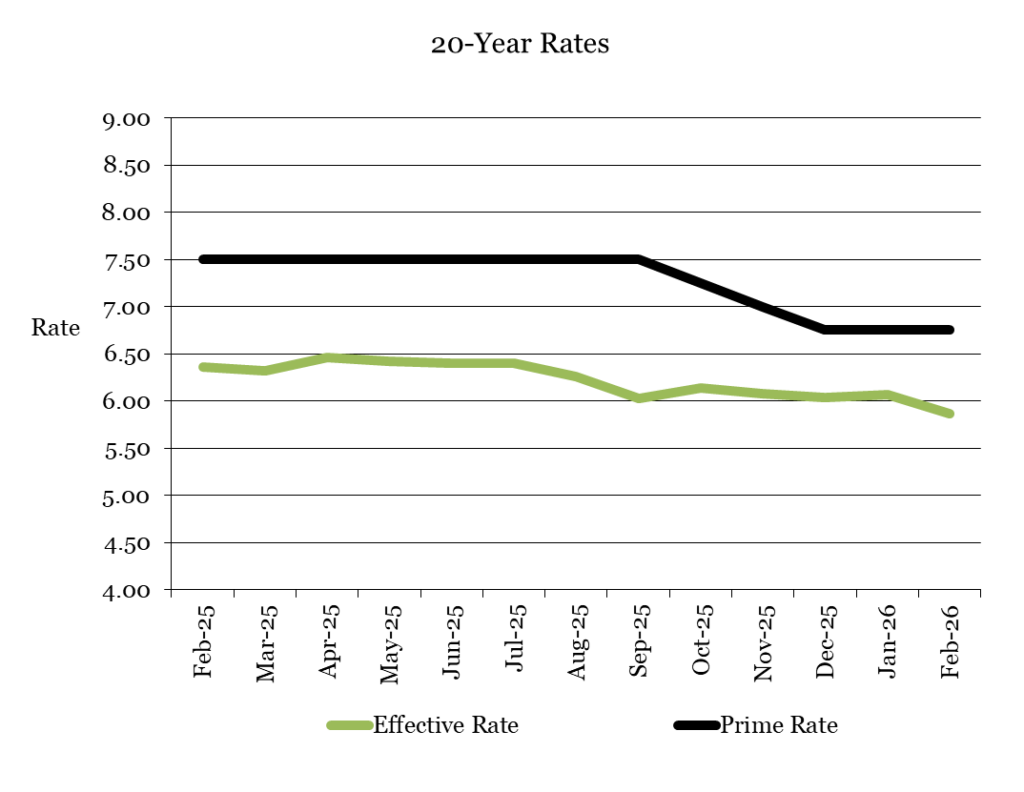

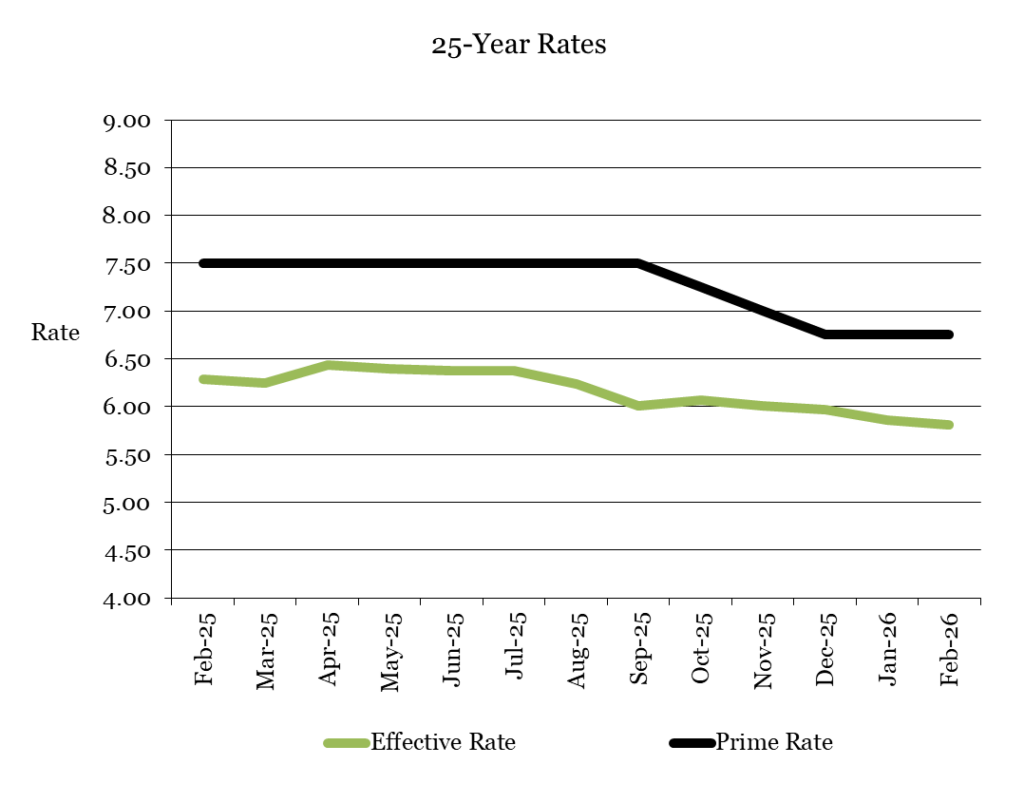

Rates are tied to the bonds that are sold to investors and the interest rates are typically reflective of the 10-year U.S. Treasury bond rate, which is a long-term, fixed-rate asset.

When discussing a new loan request, SEDA-COG will quote the current effective interest rate. However, the interest rate for a particular loan is not set until the project as defined is complete and the SBA 504 loan closes and funds. Once the rate is set it is fixed for the life of the loan. Interest rates are typically set on the first Tuesday of a month, with loans funding on the second Wednesday of the month.

SBA 504 Historical Effective Rates

FEB 25 | MAR 25 | APR 25 | MAY 25 | JUN 25 | JUL 25 | AUG 25 | SEP 25 | OCT 25 | NOV 25 | DEC 25 | JAN 26 | FEB 26 | |

25-yr | 6.29% | 6.25% | 6.44% | 6.40% | 6.38% | 6.38% | 6.24% | 6.01% | 6.07% | 6.01% | 5.97% | 5.86% | 5.81% |

25-yr Refi | 6.32% | 6.28% | 6.47% | 6.43% | 6.41% | 6.41% | 6.27% | 6.04% | 6.10% | 6.04% | 6.00% | 5.86% | 5.81% |

20-yr | 6.36% | 6.32% | 6.46% | 6.42% | 6.40% | 6.40% | 6.26% | 6.03% | 6.14% | 6.08% | 6.04% | 6.07% | 5.87% |

20-yr Refi | 6.39% | 6.35% | 6.49% | 6.45% | 6.43% | 6.43% | 6.29% | 6.06% | 6.17% | 6.11% | 6.07% | 6.10% | 5.90% |

10-yr | 6.66% | 6.35% | 6.35% | 6.22% | 6.22% | 6.19% | 6.19% | 5.78% | 5.78% | 5.84% | 5.84% | 5.86% | 5.86% |

10-yr Refi | 6.69% | 6.38% | 6.38% | 6.25% | 6.25% | 6.23% | 6.23% | 5.82% | 5.82% | 5.88% | 5.88% | 5.90% | 5.90% |